The Growth of Fintech: How Technology is Revolutionizing Financial Services (and the Importance of Data Security)

The financial technology (fintech) sector has seen explosive growth in recent years, driven by advancements in digital payments, blockchain technology, and robo-advisors. These innovations are transforming how we manage, invest, and transfer money. However, with these advancements comes the critical need for robust data security to protect sensitive financial information. In this blog, we’ll explore the latest trends in fintech and highlight the importance of data security, recommending Polar Backup as a trusted solution for safeguarding financial data.

Latest Trends in Fintech

- Digital Payments

- Overview: Digital payments have become the norm, with mobile wallets, contactless payments, and online banking facilitating seamless transactions.

- Trend: The adoption of digital payment methods continues to rise, driven by convenience and the global shift towards cashless societies.

- Blockchain Technology

- Overview: Blockchain, the technology behind cryptocurrencies like Bitcoin, offers a decentralized and secure way to record transactions.

- Trend: Beyond cryptocurrencies, blockchain is being utilized for smart contracts, supply chain management, and secure data sharing.

- Robo-Advisors

- Overview: Robo-advisors use algorithms to provide financial advice and manage investments, making wealth management accessible to a broader audience.

- Trend: The use of robo-advisors is growing, offering cost-effective and personalized investment strategies.

The Importance of Data Security in Fintech

- Protection of Sensitive Information

- Financial Data: Financial institutions handle vast amounts of sensitive data, including personal information, transaction records, and investment details.

- Threats: This data is a prime target for cybercriminals, making robust security measures essential to prevent data breaches.

- Regulatory Compliance

- Regulations: Financial institutions must comply with strict data protection regulations such as GDPR, CCPA, and PCI DSS.

- Penalties: Non-compliance can result in severe penalties, legal consequences, and loss of customer trust.

- Business Continuity

- Operational Impact: Data breaches can disrupt operations, leading to financial losses and reputational damage.

- Recovery: Having secure backup solutions ensures that financial institutions can quickly recover and resume normal operations after a cyber incident.

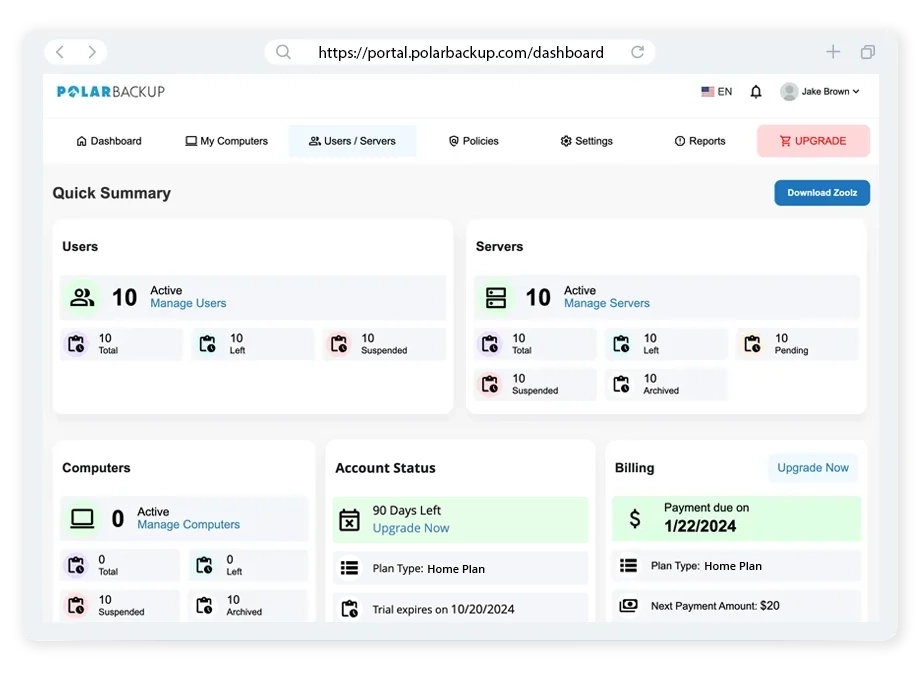

Polar Backup: A Trusted Solution for Financial Data Security

Polar Backup offers a comprehensive and secure solution designed to protect sensitive financial data, leveraging advanced features to ensure security and accessibility.

- Adaptive Storage for Business

- Scalability: Polar Backup is designed to handle large volumes of financial data, making it ideal for institutions managing extensive transaction records and customer information.

- Adaptive Storage: The system intelligently manages data, ensuring frequently accessed files are readily available while securely storing less-used data at a lower cost.

- AI-Driven Security

- Intelligent Backup: AI-driven algorithms ensure that backups are performed optimally, reducing system load and maximizing efficiency.

- Anomaly Detection: AI can detect unusual patterns in data usage, alerting institutions to potential threats before they cause significant damage.

- Cost-Effective and Compliant

- Affordable Plans: Polar Backup offers competitive pricing, providing cost-effective solutions for financial institutions of all sizes.

- Regulatory Compliance: Polar Backup ensures that all data is stored securely and in compliance with relevant regulations, helping institutions avoid penalties and maintain customer trust.

Conclusion

The fintech sector is rapidly evolving, with innovations like digital payments, blockchain technology, and robo-advisors transforming the financial services landscape. As these technologies advance, the importance of data security cannot be overstated. Polar Backup provides a robust and reliable solution for protecting sensitive financial data, leveraging adaptive storage and AI-driven security to ensure business continuity and regulatory compliance. By investing in a trusted backup solution like Polar Backup, financial institutions can safeguard their data and continue to innovate with confidence.